Key facts

Save more than the annual fee after just one night.

Annual Fee:

$99Min. Credit Score for Approval:

670-739 * GoodOngoing APR:

21.49%-28.49% VariableBalance transfer fees

Either $5 or 5% of the amount of each transfer, whichever is greater.Foreign Transaction Fee:

0%The IHG® Rewards Premier Credit Card might just be the most rewarding hotel credit card with an annual fee under $100. The IHG Premier Card grants an annual free night, automatic Platinum Elite status, a fourth reward night free, and bonus points at IHG hotels and several bonus categories. Plus, cardholders get $50 United TravelBank Cash each account anniversary year and a Global Entry application fee credit every four years. All of that for just a $99 annual fee.

Reward multipliers

Although the massive sign-up bonus points may be your primary reason for getting the IHG Premier Card, cardholders will also earn bonus points in several spending categories:

- 10X points at eligible IHG hotels worldwide

- 5X points on general travel — even at non-IHG hotels.

- 5X points at gas stations.

- 5X points at restaurants — including takeout and eligible delivery.

- 3X points on all other purchases.

In addition to bonus points earned through spending, the IHG Rewards Premier Credit Card offers cardholders two big spending bonuses. First, cardholders will earn a $100 statement credit plus 10,000 bonus points earned after spending $20,000 in a calendar year. Then you can earn Diamond Elite status by spending $40,000 in a calendar year.

Earns bonus points for spend in the following bonus categories:

10 points per dollar at eligible IHG hotels worldwide; 5X points per dollar on any other hotel purchases.

Estimated Rewards Value: 4%

Estimated Rewards Value: 2%

Estimated Rewards Value: 2%

Estimated Rewards Value: 2%

Estimated Rewards Value: 2%

Estimated Rewards Value: 2%

Estimated Rewards Value: 1.2%

Key features

Unique Card Benefits

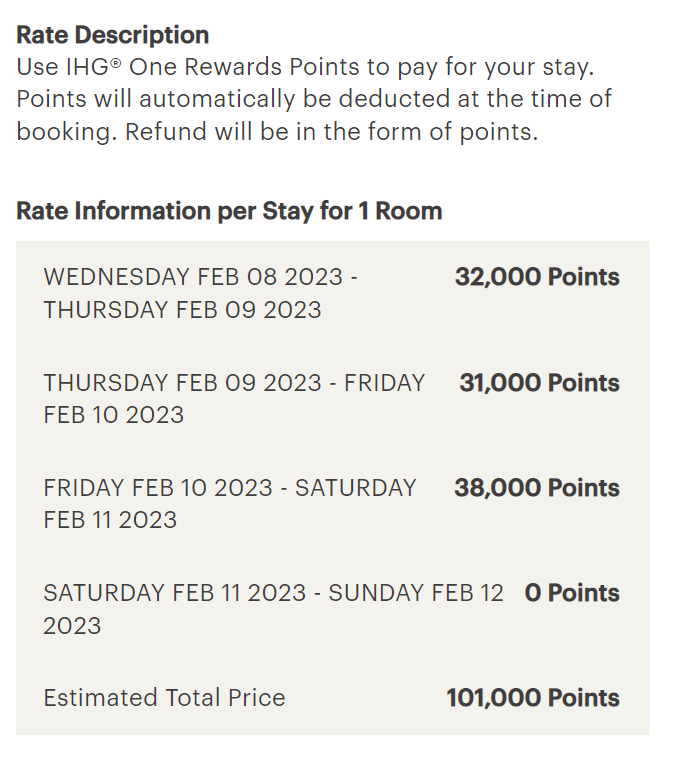

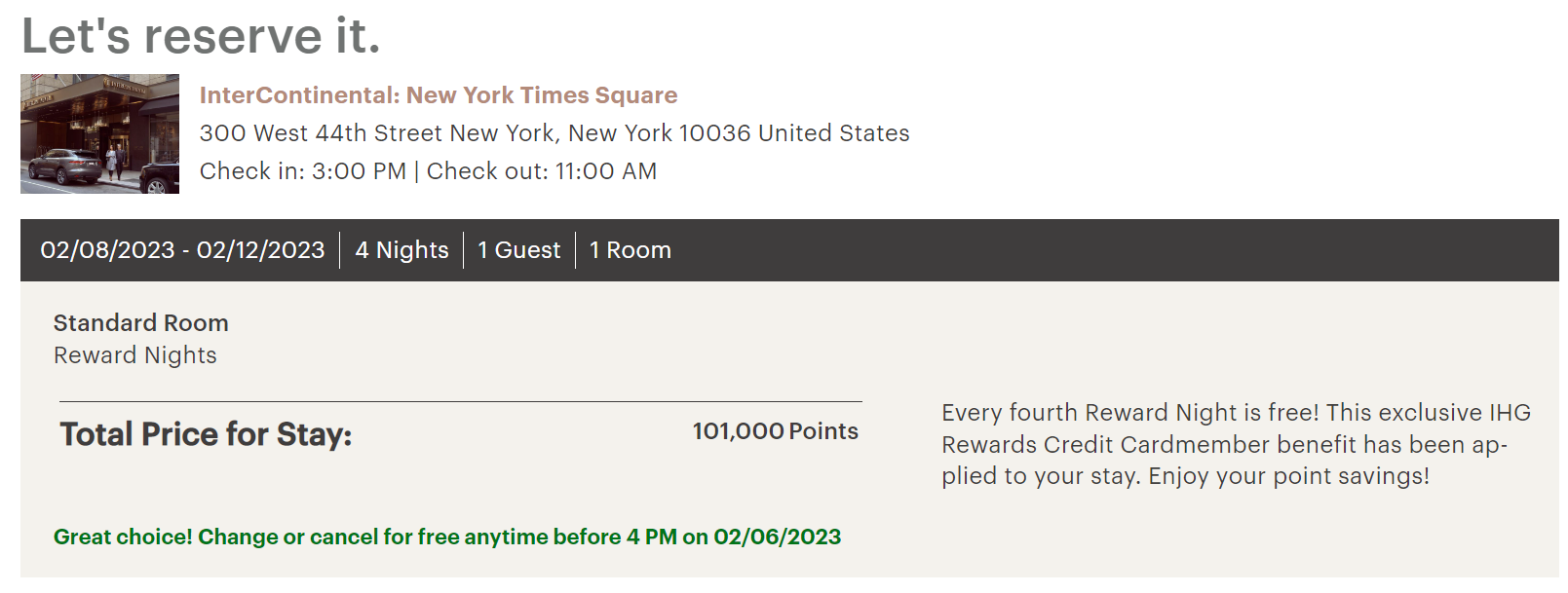

Fourth Reward Night Free

Get a reward night free when you redeem points for four (or more) consecutive rewards nights. You’ll pay for 3 with your points and IHG will give you one of the nights free.

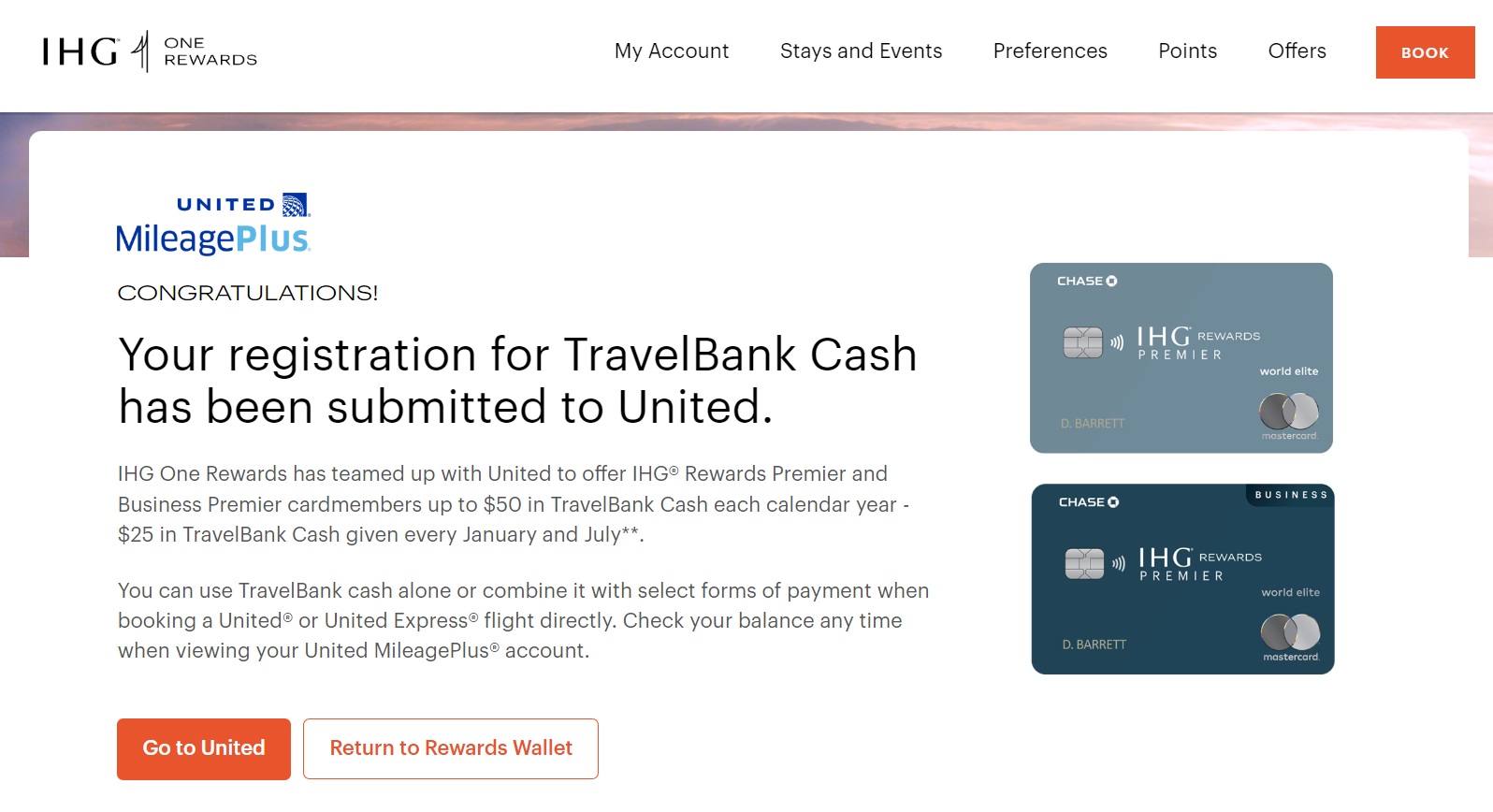

United TravelBank Cash

IHG Premier Card cardholders get $25 of United TravelBank credit deposited into their linked United account twice per year, for a total of $50 per year.

20% off IHG Points Purchases

Use your IHG Rewards Premier Credit Card to purchase IHG points and get a 20% discount off the standard rate. However, this discount isn’t available when IHG offers a point sale.

Free Annual Hotel Night

Get a free night certificate worth up to 40,000 IHG points each account anniversary year.

Grants Hotel Status

IHG Rewards Premier Card primary cardholders get IHG Platinum Elite status. Boost your IHG elite status to Diamond Elite status by making at least $40,000 in eligible purchases.

Annual Statement Credits

Earn a $100 statement credit and 10,000 bonus points each year you make at least $20,000 in eligible purchases using your IHG Premier Card.

Global Entry / TSA PreCheck Reimbursement

Get a Global Entry, TSA PreCheck, or NEXUS statement credit of up to $100 every four years when you charge your application fee to your IHG Rewards Premier Credit Card.

Secondary Car Rental CDW Waiver

Decline the rental company’s collision insurance and charge your entire car rental to your IHG Rewards Premier Credit Card to get complimentary theft and collision damage protections. Coverage is secondary for rentals within the United States. Terms and conditions apply.

Extended Warranty

Purchase goods with your IHG Rewards Premier Credit Card and get an additional year of warranty on eligible warranties of three years or less.

Purchase Protection

Protects your purchases against damage and theft for up to 120 days by using your IHG Rewards Premier Credit Card to make the purchase.

Trip Protections

The IHG Rewards Premier Credit Card offers trip cancellation/interruption insurance, lost luggage reimbursement, baggage delay insurance, and travel accident insurance.

No Foreign Transaction Fees

Overseas purchases won’t incur foreign transaction fees.

Travel and Emergency Assistance Services

If you experience an issue when traveling, call the Chase Benefit Administrator to get legal and medical referrals or other travel and emergency assistance. Associated costs are not covered by this benefit.

No Fees for Authorized Users

Earn additional IHG Rewards points by adding authorized users at no additional annual fee.

Free Access to Credit Score

Keep up to date on your credit scores through Chase Credit Journey.

Earn more rewards by combining credit cards

Pros & cons

- Get Platinum Elite status, a fourth night free, and a free night certificate each account anniversary year.

- Score other travel perks like United credits and Global Entry, TSA PreCheck, or a NEXUS statement credit.

- Earn bonus points at IHG Hotels, and on travel, gas stations, and dining.

- Low IHG point value means a limited return on spending.

- Eligibility is limited to those who meet Chase 5/24 requirements.

Our review

The IHG Premier Credit Card can justify its place in any traveler’s wallet. After earning the excellent sign-up bonus, cardholders continue to be rewarded with IHG Platinum Elite status, an annual free night award, a reward night free on a reward stay of four or more consecutive nights, $50 per year in United TravelBank Cash, and a Global Entry/TSA PreCheck/NEXUS application fee credit.

Those perks easily justify the $99 annual fee, even if you use a more rewarding card for everyday spending.

Cardholders earn bonus points in a variety of categories, including 10X IHG points on eligible purchases at IHG hotel brands and 5X points on travel, at gas stations, and on dining. All other purchases earn 3X points.

MilesTalk values IHG Rewards points at 0.4 cents each. That means IHG Premier Card cardholders can expect an approximate return of around 4% on spending at IHG Hotels and 1.2% on other purchases.

For those unfamiliar with IHG Rewards, the IHG Rewards program includes hotel brands like InterContinental Hotels, Six Senses, Kimpton, and Hotel Indigo on the luxury end and Holiday Inn Express, Holiday Inn, and Staybridge Suites for more practical stays.

Thanks to the Platinum Elite status that comes as a benefit on the IHG Premier Card, cardholders will earn 60% bonus points on stays, get complimentary room upgrades, and receive welcome bonus points when staying at participating IHG hotels.

For travelers that generally stay at least four nights, the IHG Premier Card’s fourth-night free benefit can save you a bunch of points. All you need to do is book at least four consecutive nights at an IHG hotel using your IHG Rewards points. And IHG will automatically discount one night to zero points — giving you a free reward night.

You’ll get this perk whether you’re staying at a practical Holiday Inn or staying at ultra-luxurious InterContinental Hotels.

Frequently asked questions

Does the IHG Premier Card offer a Global Entry or TSA PreCheck fee credit?

The IHG Rewards Premier Credit Card offers cardholders a Global Entry, TSA PreCheck, or NEXUS application fee statement credit once every four years.

How hard is it to get a IHG credit card?

Potential cardholders generally need excellent credit scores to get the IHG Rewards Premier Credit Card. Credit scores of over 700 are recommended.

How much are IHG Premier points worth?

The IHG Rewards Premier Credit Card earns IHG Rewards points. MilesTalk values these points at 0.4 cents per point. However, you can get much more value than this by redeeming points for a free night at IHG properties offering a higher redemption rate.

Is the IHG Premier Card worth it?

Between the annual free night certificate, automatic elite status, fourth night free perk, and lack of foreign transaction fees, we believe the IHG Rewards Premier Credit Card is easily worth its $99 annual fee.

Does the IHG Premier Card charge a foreign transaction fee?

You can make purchases in the U.S. and abroad without worrying about extra fees.

The IHG Rewards Premier Credit Card doesn’t charge foreign transaction fees.

What is the automatic elite status on the IHG Premier Card?

The automatic elite status that comes with the IHG Rewards Premier Credit Card is Platinum Elite status.

However, you can earn top-tier Diamond Elite status by spending $40,000 on the IHG Premier Card in a calendar year.

What are the benefits of IHG Platinum Elite status?

The IHG Rewards Premier Credit Card offers Platinum Elite status, which offers complimentary room upgrades, 60% bonus points, periodic reward night discounts, guaranteed room availability, and other perks like welcome bonus points when you check in to an IHG hotel.

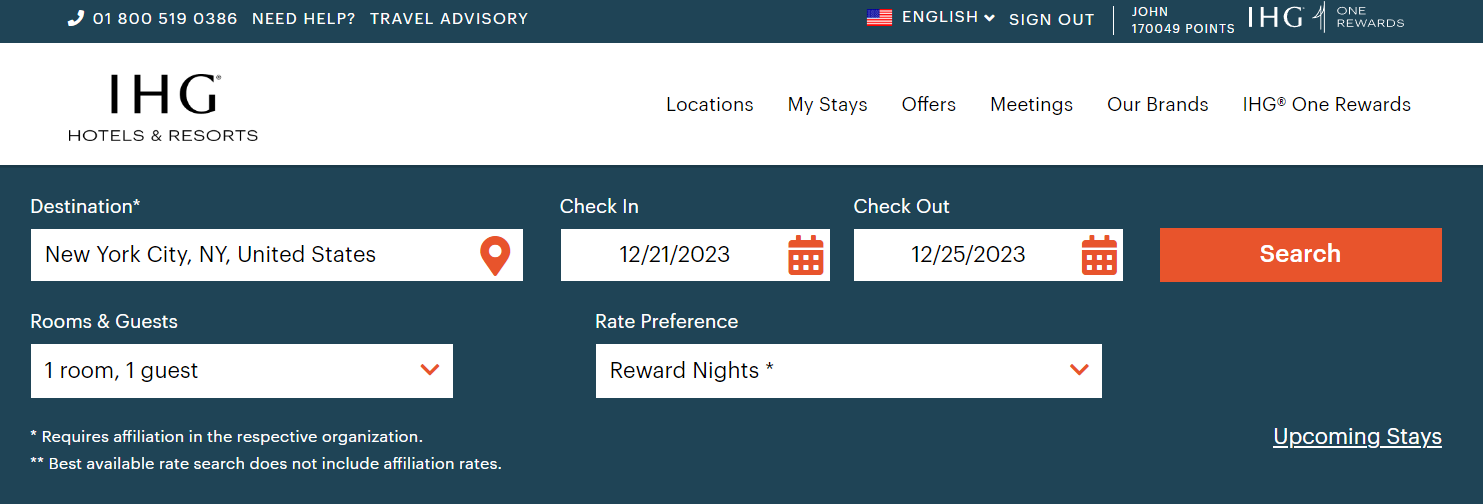

How do you redeem points at IHG hotels?

Redeeming points is easy. Just log into your IHG Rewards account and browse to the IHG homepage to begin your search. Under the Rate Preference, select “reward nights” and then click search.

Should you transfer Chase Ultimate Rewards to IHG Rewards?

Chase Ultimate Rewards points can be redeemed for cashback at 1 cent per point. So, it only makes sense to transfer points to IHG if you can redeem points for at least this much value. Even so, Chase Ultimate Rewards points can provide even more value through other airline and hotel transfer partners — such as Southwest, United, and Hyatt.

Is IHG one of the best hotel loyalty programs?

The best hotel loyalty program for you depends on your travel preferences. IHG Rewards membership lets you earn and redeem points at a wide variety of hotel brands, from luxurious InterContinental Hotels to practical Holiday Inn Express stays.

Other popular hotel loyalty programs include Marriott Bonvoy, World of Hyatt, and Hilton Honors.

Can you redeem IHG points for travel other than IHG hotel stays?

Instead of redeeming IHG Hotel points for reward stays, you can transfer IHG points to several airline loyalty programs.

However, this is generally a poor use of IHG Rewards points due to the transfer ratios.

How do you earn bonus points on the IHG Rewards Premier Credit Card?

Earn 10X points on eligible purchases at IHG properties; 5x points on travel, dining, and at gas stations; and 3X points on all other purchases. MilesTalk values IHG Rewards points at 0.4 cents each. That means purchases of travel, dining, and gas stations earn around a 2% return.