Capital One Miles: What are they?

Four Capital One consumer and small business credit cards offer rewards in the form of Capital One Miles. Currently, Capital One points can be transferred to 17 airline and hotel partners, redeemed for travel expenses at 1 cent per mile, or redeemed for other mediocre redemption alternatives (covered in detail below).

You might be familiar with the statement credit feature even if you haven’t kept up with the most current modifications to the Capital One Miles program. The ability to transfer Capital One Miles to hotels and airlines, however, is a very recent development.

You’ve probably heard advertisements over the years for the Capital One Venture Card promoting the opportunity to earn “two miles” for every dollar spent on all purchases with no blackout periods. Yet up until recently, the Venture Card was just a 2% cashback card for travel; you could only use Capital One “miles” to cancel travel expenses or book travel through Capital One at a cost of one penny per point.

Later, in 2018, Capital One introduced fresh airline transfer alliances. Even then, at best, 1.5 airline miles for every 2 Capital One Miles were transferred to airline partners. Yet, it appears that promoting the possibility of accumulating 1.5 airline miles for every dollar spent lacked the same resonance.

But, following a number of transfer partner upgrades in 2021, Capital One has at last arrived. With more than 15 airline and hotel transfer partners, Capital One solidifies its position as one of the top transferable points programs, joining American Express Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou Points.

Which Credit Cards Earn Miles with Capital One?

Capital One Miles can be directly earned on five Capital One credit cards:

- The Capital One VentureOne Rewards Credit Card, which carries no annual fee, is one of these cards.

- There is the Capital One Venture Rewards card, the premium Capital One Venture X Credit Card and the Capital One Venture X Business Card

- And then the Spark Miles, and the Spark Miles Select.

We will discuss how to earn Capital One Miles using a backdoor method involving other Capital One credit cards later. To earn Capital One Miles, you must have at least one of the following four credit cards, though.

Capital One Venture X

The Capital One Venture X Credit Card, one of Capital One’s newest cards, is the one garnering the most attention. Don’t be deterred by the $395 annual fee of this credit card. A few of the useful (and user-friendly) perks of the card can easily offset the annual charge.

The Capital One Venture X Card has ongoing advantages like:

- With all purchases, you can earn 2X Capital One Miles.

- When making hotel and rental vehicle reservations with Capital One Travel, earn 10X Capital One Miles.

- For flights purchased through Capital One Travel, earn 5X Capital One Miles.

- For reservations made on Capital One Travel, cardholders receive a $300 travel credit annually.

- 10,000 bonus miles every anniversary of the account. That reduces the effective annual charge by at least $100.

- Membership in Priority Pass Select and admission to Capital One’s own network of lounges.

- President’s Circle elite status at Hertz until Dec 2024).

- Statement credits of up to $100 are available for TSA PreCheck or Global Entry application costs.

- Protections for travel and purchases, such primary Car Rental Collision Damage Waiver, Return Protection, Extended Warranty, Travel Accident Insurance, Mobile Phone Protection, and more.

- Authorized users pay no additional annual fee and receive benefits including Priority Pass, Hertz President’s Circle, and access to Capital One Lounges.

- No foreign transaction fees.

Capital One Venture X Business

Nearly identical to the Venture X, but with no pre-set spending limit, and no Hertz President’s Circle status.

Capital One Venture

The “OG” Venture Card is the Capital One Venture Card, compared to the Venture X Card – the newest card on the block. The Venture Card accrues 2X Capital One miles on all purchases, just as the Venture X. Nevertheless, the card’s somewhat reduced $95 annual charge comes with far fewer benefits.

The Venture Card has the following benefits:

- Every purchase earns 2X Capital One Miles.

- When making hotel and rental vehicle reservations with Capital One Travel, earn 5X Capital One Miles.

- Statement credits of up to $100 are available for TSA PreCheck or Global Entry application costs.

- Each additional visit to the Capital One lounge costs $45 after the first two complimentary ones.

- Hertz Five Star Elite Status

- Protections for travel and purchases include supplemental Collision Damage Waiver for Car Rentals, Extended Warranties, Travel Accident Insurance, and more.

- No foreign transaction fees.

Capital One Spark Miles for Business card

The Capital One Spark Miles for Business card is the only small business credit card offered by Capital One that (directly) generates Capital One Miles. Cardholders can earn 2X Capital One Miles on all purchases or 5X Capital One Miles when they use Capital One Travel to book a hotel or rental car. The first year’s annual fee is free; subsequent years are $95.

- Every purchase earns 2X Capital One Miles.

- When making hotel and rental vehicle reservations with Capital One Travel, earn 5X Capital One Miles.

- Statement credits of up to $100 are available to cover for TSA PreCheck or Global Entry application costs.

- Visits to a Capital One lounge are free the first two times each year, after which they cost $45 each.

- Employee cards do not have an additional annual fee.

There is also a Capital One Spark Miles Select for Business that has no annual fee, but with only 1.25 miles for every dollar spent rather to 2, this would only be a better alternative for very modest spenders.

Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card is the only personal Capital One card with no annual fee that earns Capital One Miles. You will give up a lot of your potential mileage earning in return for not paying an annual fee. With every purchase made with the Capital One VentureOne card, only 1.25X miles are earned.

Despite its low earning potential, the Capital One VentureOne Rewards card offers access to the Capital One Miles program.

The card’s limited benefits consist of:

- On every purchase, you earn 1.25X Capital One Miles.

- When making hotel and rental vehicle reservations with Capital One Travel, earn 5X Capital One Miles.

- Get benefits like Car Rental Collision Damage Waiver, Extended Warranty, and Travel Accident Insurance if you are approved for a Visa Signature card.

- No foreign transaction fees.

- Combine Capital One Rewards Across Different Capital One Cards

You can transfer Capital One Miles or cashback earnings between qualifying cards if you have multiple Capital One cards.

Cashback awards can also be converted into Capital One Miles with Capital One Rewards Transfers.

There are three ways to move Capital One rewards between accounts:

- Transferring from one cashback card to another.

- Transferring one Capital One Miles card to another Capital One Miles card.

- Transferring to a Capital One Miles card from a cashback card.

That third choice has the potential to be very rewarding.

Consider if you had a Capital One SavorOne Rewards card. With this card, you can get 3% cash back on entertainment, restaurants, and well-known streaming services.

Although earning 3% cashback is excellent, 3X Capital One Miles can be far more beneficial. Also, you may effectively earn 3X Capital One Miles on these transactions by changing your Savor Rewards reward to a Capital One Miles earning card.

Transferring Capital One Rewards to Other Accounts

To transfer Capital One points between Capital One card accounts, follow these steps:

With Capital One, there are no fees associated with transferring miles or points between accounts, unlike some hotel and airline loyalty programs. Moving rewards among accounts is free at Capital One.

And, importantly, transferred Capital One Miles never expire.

Capital One Transfer Partners (Airline and Hotel)

You can transfer your Capital One miles to the following hotel programs and airline transfer partners. Unless otherwise stated, all partners receive a 1:1 transfer ratio of Capital One miles:

| Capital One Miles | ||

|---|---|---|

| Transfer Ratio | Expected Transfer Time | |

| Air Canada (Aeroplan) | 1:1 | Instant |

| Air France / KLM Flying Blue | 1:1 | Instant |

| Avianca Lifemiles | 1:1 | Instant |

| Aeromexico | 1:1 | Instant |

| British Airways Avios | 1:1 | TBD |

| Cathay Pacific Asia Miles | 1:1 | Nearly instant |

| Choice Hotels | 1:1 | 1 day |

| Emirates Skywards | 1:1 | Instant |

| Etihad Guest | 1:1 | 1-2 days |

| Finnair | 1:1 | Instant |

| Qantas | 1:1 | 1-2 days |

| Singapore Airlines KrisFlyer | 1:1 | 1-2 days |

| TAP Air Portugal | 1:1 | TBD |

| Turkish Airlines Miles&Smiles | 1:1 | TBD |

| Wyndham Rewards Hotel Program | 1:1 | Instant |

| EVA | 2:1.5 | 1-2 days |

| Accor Live Limitless (ALL) Hotel Program | 2:1 | 1-2 days |

| Virgin Red | 1:1 | TBD |

Can I Transfer Capital One Miles to United or Delta?

We get this question a lot. You cannot transfer to United; only Chase Ultimate Rewards and Bilt Rewards can do so.

The same question about transferring Capital One Miles to Delta is also asked often. Again, Once more, you are unable to transfer rewards to Delta; only American Express Membership Rewards transfer there.

You can still book award flights on Delta and United utilizing Skyteam or Star Alliance partners. For instance, booking United with Capital One miles converted to the Turkish Miles&Smiles program.

Capital One Miles: Redemption Options

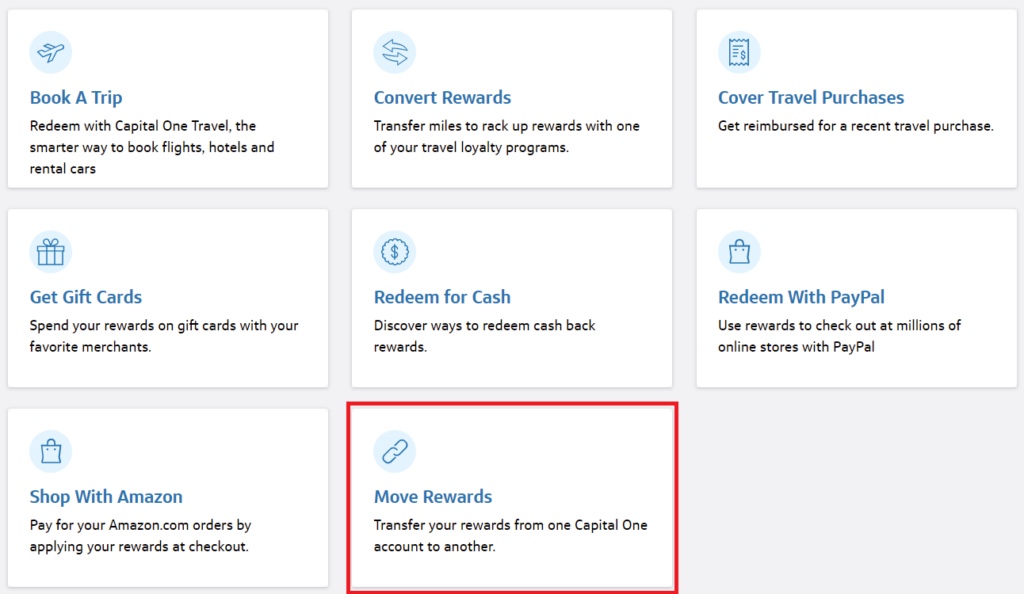

The eight options to redeem your Capital One Miles are listed by Capital One. These redemption possibilities are, from most valuable to least valuable, in the following order:

- Airline and hotel transfer partners (mostly 1:1 transfers).

- Use Capital One Travel to arrange your travel (1 cent per mile).

- Pay for recent travel expenses that were billed to your card (1 cent per mile).

- Acquire gift cards (between 0.8 and 1 cent per mile).

- Redeem via PayPal (0.8 cents per mile).

- Buy things on Amazon (0.8 cents per mile).

- Exchange for cashback rewards (0.5 cents per mile).

- Finally, you have the option of transferring rewards to another Capital One account. For each Capital One mile transferred, you will receive the same one Capital One mile. Alternatively, if your card offers cash back, you can move your rewards to another cashback card or a card that offers mileage rewards.

What is the Value of Capital One Miles?

It is somewhat arbitrary and varies depending on how you decide to redeem, as you can see from the previous section. They are only worth one cent when used to pay for or book travel, but they may be transferred to a partner like Turkish to receive incredible value. We currently value Capital One miles at 1.6 cents each overall.

Capital One Miles’s Sweet Spots

Transferring miles to airline and hotel partners offers the best value for your Capital One Miles..

But, there is much more variability in the redemption rate you can obtain from these redemptions than there is when redeeming Capital One Miles for flat-rate ticket purchases. You could wind up with less value per mile if you don’t choose the best partner for the flight you want or if use them for a low value redemption

On the other hand, the top redemptions offers offer multiple cents per Capital One Mile in value, making them the best ways to use Capital One Miles. Here are some of the Capital One Miles transfer partners’ top sweet spots:

- United offers domestic flights within the U.S. for 10,000 miles roundtrip in economy class or 15,000 miles in business class with Turkish Miles&Smiles, including trips to Hawaii. You can even travel anyplace in Mexico, Canada, or the Caribbean for only a few more miles!

- Hotel stays with Wyndham Rewards start at 7,500 points per night. Villas with one bedroom start at 15,000 points per night. Or use “Go Quick” rewards to redeem as few as 3,000 points plus cash.

- Flying Blue is offering round-trip tickets on Air France for 25,500 miles to Tahiti.

Which credit bureaus are checked when a Capital One Card application is submitted?

When evaluating whether or not to approve you for a new card, Capital One is one of the few banks that may request a copy of your credit report from all three major credit agencies (TransUnion, Experian, and Equifax).

This is significant for a number of factors. First off, if you have a negative item on any of your credit bureau reports, Capital One may reject your application. Also, you’ll likely see a “hard pull” inquiry on each of your three credit reports. This means that whether or not you are approved for a new Capital One credit card, there will likely be a brief decline in all three of your primary credit scores. However, that is not really a big deal as your score generally comes right back within a few weeks.

Airport Lounges by Capital One

The opportunity to attend Capital One Lounges is one of the newest benefits of the Capital One Venture and Spark Credit cards. In Dallas/Fort Worth, the first facility in this new network of airport lounges opened its doors in November 2021.

The quality of this new Capital One Lounge has left Capital One cardholders speechless, from the delicious food and custom-made drinks to the unique extras like a workout facility and yoga studio.

Locations and hours for Capital One Lounges

Open: Dallas/Fort Worth (DFW): near gate D2, opens at 6 a.m., closes at 9 p.m.

Coming Soon: Denver (DEN) and Washington Dulles (IAD) will open next (TBD).

Entrance to Capital One Lounges

Not all Capital One cardholders are eligible for complimentary access to Capital One Lounges. Below is a breakdown of each card’s access to the Capital One Lounge:

- Venture X: Unlimited access for cardholders (including authorized users) and up to two guests. Additional guests cost $45 each.

- Venture X Business: Unlimited access for cardholders (including authorized users) and up to two guests. Additional guests cost $45 each.

- All other Capital One cardholders and the general public: $65 per person per visit.

Spend with Spark Cash Plus; convert cashback to Capital One miles as part of an advanced strategy

If you’re a heavy spender, you should look at the Capital One Spark Cash Plus. The Spark Cash Plus is a 2% cashback small business card.

The Spark Cash Plus is a charge card, not a credit card, therefore it doesn’t have pre-set spending limitations, unlike the majority of Capital One credit cards. Heavy spenders won’t have to worry about making payments halfway through the month to avoid running out of available credit.

Moreover, Capital One will not report to your personal credit report with any new Spark Cash Plus cards. As a result, you won’t need to be concerned about a high credit utilization rate lowering your credit score.

Would you rather earn 2X miles on your Spark Cash Plus spend?

Getting a Capital One Venture Card, Venture X Card, or Spark Miles Card is all that is required. Move your Spark Cash Plus cashback earnings to one of these cards next to effectively convert them to Capital One Miles that may be transferred to airline and hotel partners.

Capital One Application Rules

Like every other card issuer, Capital One has some unwritten guidelines regarding who qualifies for new cards and how frequently you can apply for new cards. The current application limitations applied by Capital One are listed below:

You are only allowed to have two consumer cards. This cap excludes small business cards from Capital One as well as co-branded cards (like the Walmart Store Card).

When to apply: You can only get one consumer or small business card from Capital One every six months.

Pre-approval: To determine whether you are pre-approved for any Capital One cards, Capital One offers a 9-step pre-approval form. To check if you comply with the Capital One application requirements, this can be a valuable tool.

Upgrades, Downgrades, and Product Changes from Capital One

Holders of the Capital One Venture card can upgrade to the Venture X card. In fact, Capital One has made targeted offers of 50,000 bonus miles to those cardholders who accept. The benefit of upgrading in this way is that you can avoid getting new inquiries and accounts on your credit report.

The bonus offer that is now being given to new Capital One Venture X cardholders will be lost, though.

Calling the number on the back of your card is a good place to start if you’re interested in learning more about your Capital One upgrade choices.

You might be wondering if Capital One will check your credit report prior to a product change given that Capital One analyzes all three credit agencies when you apply. Thank goodness, that’s not the case. Thus, you won’t need to be concerned about a hard pull on your credit.

You can also call to downgrade a card from a premium version (with an annual cost) to a no-annual-fee version, but you’ll lose a lot of potential rewards due to lower earning rates and, in most circumstances, would have been better off paying the annual fee.

Remember that you must downgrade your Capital One card at least 60 days before your annual fee posts if you’re doing so in order to avoid paying one. You won’t receive a refund of the annual charge you paid if you downgrade within 60 days of the fee posting or beyond.

Thinking about applying for a Capital One mile-earning credit card?

Use these links:

- Capital One Venture X Business

- Capital One Spark Miles for Business

- Capital One Venture X

- Capital One Venture

- Capital One VentureOne

Summary

Before, Capital One Miles were merely points that could be used for travel-related expenditures. But those times are long gone because Capital One has fully entered the transferable points market and now offers a wide range of redemption options for Capital One Miles.

Questions or Comments?

The best way to ask questions about this topic is in the private MilesTalk Facebook group, where we discuss all things related to credit card rewards.

You can also follow MilesTalk / Your Best Credit Cards on Twitter, and on Instagram for anything related to miles, points, credit cards, and travel.