Are you ready to unlock the true potential of your Chase credit cards? Chase Ultimate Rewards is a powerhouse rewards program that offers incredible flexibility and earning potential. In this guide, we’ll dive into the world of Chase Ultimate Rewards, revealing the ins and outs of the program, the various credit cards that earn points, and how to maximize your rewards. Let’s embark on this journey to unleash the full potential of your Chase Ultimate Rewards points!

Short Summary

- Chase Ultimate Rewards offers great flexibility & rewards opportunities, plus a selection of credit cards to help you earn points. With only one exception (the Ink Premier), all cards that award Ultimate Rewards points can be combined into any other card you have.

- Maximize your Chase UR. Points by combining them with family members, strategically spending on bonus categories and taking advantage of additional earning methods like Shop Through Chase and Refer-A-Friend.

- Redeem for travel through the portal or transfer to airline/hotel partners for maximum value!

Understanding Chase Ultimate Rewards

Chase Ultimate Rewards is a treasure trove of rewards opportunities, allowing you to earn points with eligible Chase credit cards and redeem them for a range of options, such as cash back, travel, gift cards, and more. With a lineup of versatile cards and a plethora of airline and hotel partners, the possibilities are endless.

The key to unlocking the full potential of your Chase Ultimate Rewards points lies in understanding the program’s basics and leveraging its benefits. So let’s dive in and start exploring!

The Basics

To begin, let’s first establish the foundation of the Chase Ultimate Rewards program. By using eligible Chase credit cards for your purchases, you’ll earn at least one point for every dollar spent. Points can be earned through regular spending, sign-up bonuses, special offers, and referral bonuses. Some cards, like the Ink Cash, can earn as many as 5 points per dollar on select bonus categories!

The true value of your Chase Ultimate Rewards points depends on how you choose to redeem them. For example, points redeemed for cash back are worth a penny each, while those redeemed for travel through the Chase Ultimate Rewards portal can be worth 1.25-1.5 cents each, depending on the card you hold. The vest value of all lies in transferring points to Chase’s air and hotel transfer partners, like World of Hyatt and United Airlines.

The key to maximizing your points lies in choosing the most valuable redemption options.

Benefits of Chase Ultimate Rewards

The Chase Ultimate Rewards program boasts a wide array of advantages, offering flexible redemption options and an extensive list of credit cards to earn points from. This flexibility means you can tailor your rewards strategy to suit your preferences and lifestyle.

One of the most attractive features of Chase Ultimate Rewards is its impressive list of airline and hotel partners. By transferring your points to these partners, you can potentially unlock even greater value for your rewards. Additionally, with a vast array of bonus categories and sign-up bonuses, there are ample opportunities to accumulate points quickly and efficiently.

Chase Credit Cards that Earn Ultimate Rewards

Chase offers a variety of credit cards that can help you earn Ultimate Rewards points, each with its own unique rewards structure and benefits. From the popular Sapphire Preferred and Reserve cards to the versatile Freedom Unlimited and Flex cards, there’s a card for everyone.

Let’s take a closer look at each of these cards and their respective perks to help you choose the best one for your needs.

Chase Sapphire Preferred®

The Chase Sapphire Preferred® Card is a travel rewards card that offers an array of benefits and spending bonuses for a reasonable $95 annual fee.

As for earning potential, the Chase Sapphire Preferred lets you rack up 5x points on travel booked through Chase Ultimate Rewards, 3x points on dining at restaurants, 3x points on eligible online grocery purchases and select streaming services, 2x points on other travel purchases, and 1x points on all other purchases. This diverse array of bonus categories makes the Sapphire Preferred an excellent choice for those who love to travel and dine out.

Chase Sapphire Reserve®

For those seeking a more premium travel rewards experience, the Chase Sapphire Reserve® is a top contender. This card offers a 50% bonus when redeeming points through the Chase Ultimate Rewards portal. This makes your points even more valuable for travel redemptions.

The card offers numerous ways to earn bonus points. For example, you’ll be awarded 10x the amount of points on hotels and car rentals when booked through Chase Ultimate Rewards after the first $300 spent on travel purchases every year. You will also receive 5x points on flights purchased through Chase Ultimate Rewards after the first $300 spent annually on travel purchases. Plus, you’ll get 3x points for other travel worldwide and dining at restaurants, and 1x points on all other purchases.

With these impressive earning rates, the Chase Sapphire Reserve® is perfect for frequent travelers seeking luxury and flexibility.

Chase Freedom Unlimited®

If cash back rewards are more your style, the Chase Freedom Unlimited® is a fantastic option. This card offers a base earning rate of 1.5% cash back on all purchases, with cash back earned in the form of Ultimate Rewards points. There’s also no annual fee, making it an accessible choice for most users.

In addition to its base earning rate, the Freedom Unlimited card provides bonus rewards on specific spending categories, such as 5% cash back on travel booked through Chase, 3% back at restaurants, 3% back at drugstores, and 1.5% on all other purchases. The combination of cash back rewards and no annual fee makes the Freedom Unlimited an appealing choice for those seeking an easy-to-use rewards card.

But remember what I said before about combining Ultimate Rewards points? It’s important to note that the points earned from the Freedom Unlimited on their own are worth just a penny each.

But if you also have a Chase Sapphire Reserve®, Chase Sapphire Preferred®, or Chase Ink Business Preferred® Card, then you can transfer your points from the Freedom Unlimited to those cards, where you can redeem in the Ultimate Rewards portal at a value of 1.25-1.5 cents per point or transfer to airline and hotel partners.

Chase Freedom Flex

The Chase Freedom Flex is a versatile cash back rewards card that offers rotating bonus categories every quarter. With no annual fee, this card is perfect for those seeking a rewards card with a bit of variety.

The card’s rotating bonus categories allow you to earn 5% cash back on up to $1,500 in combined purchases each quarter, providing ample opportunities to maximize your rewards.

Additionally, the Freedom Flex offers 5% cash back on travel purchased through Chase Ultimate Rewards, 3% back at restaurants, 3% back at drugstores, and 1% on all other purchases.

Once again, if you also have a Chase Sapphire Reserve®, Chase Sapphire Preferred®, or Chase Ink Business Preferred® Card, then you can transfer your points from the Freedom Unlimited to those cards, where you can redeem in the Ultimate Rewards portal at a value of 1.25-1.5 cents per point or transfer to airline and hotel partners.

(All information about the Chase Freedom Flex® Credit Card has been collected independently by Your Best Credit Cards)

Chase Ink Business Preferred®

For business owners, the is an excellent choice. This card offers a variety of perks and an impressive sign-up bonus of 100,000 Chase Ultimate Rewards points after meeting a minimum spend requirement on purchases within the first three months of account opening.

When it comes to earning points, the Ink Business Preferred provides 3x points on the first $150,000 combined spend each year on travel and select business categories, such as shipping, advertising on social media and search engines, and internet, cable, and phone services.

The card also comes with a suite of valuable benefits, including no foreign transaction fees, cell phone protection up to $1,000 per claim, and purchase protection, making it an ideal choice for business owners seeking a versatile rewards card.

Chase Ink Business Cash®

The Chase Ink Business Cash® card is a fantastic option for business owners looking for cash back rewards with no annual fee. This card gives you 5% of cash back on office supplies and services like internet, cable and phone, up to $25,000 annually. It’s a great way to save money!

Additionally, the Ink Business Cash card provides 2% cash back at gas stations and restaurants, again up to $25,000 spent per year combined, and 1% cash back on all other purchases.

While the Ink Business Cash card does not allow for direct transfers to Chase’s travel partners, you can pair it with a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred card to unlock this feature.

Chase Ink Business Unlimited®

The Chase Ink Business Unlimited® card is a straightforward, no-annual-fee business credit card that offers 1.5% cash back on all purchases, with cash back earned in the form of Ultimate Rewards points. This card also features a generous sign-up bonus.

The Ink Business Unlimited card comes with a range of perks, primarily its cash back rewards. Other benefits include extended warranty protection, auto rental collision damage waiver, purchase protection, and roadside dispatch.

This card is perfect for business owners in search of a simple, no-frills cash back rewards card.

Again, while the Ink Business Cash card does not allow for direct transfers to Chase’s travel partners, you can pair it with a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred card to unlock this feature.

The Chase Trifecta

A popular strategy among Chase Ultimate Rewards enthusiasts is the Chase Trifecta, which typically consists of the Sapphire Reserve or Sapphire Preferred, Freedom Unlimited and Freedom Flex. By holding these three cards, you can take full advantage of their respective rewards structures and combine points for an even greater redemption value.

On the business side, you can get a potentially even more enticing Trifecta with the

This powerful trio allows you to maximize your earning potential and unlock the best perks that Chase Ultimate Rewards has to offer.

Which Chase Ultimate Rewards Cards Can Transfer to Airline and Hotel Partners?

While many Chase cards earn Ultimate Rewards points, only the Sapphire Preferred, Sapphire Reserve, and Ink Business Preferred cards allow for point transfers to airline and hotel partners. If you hold one of these cards, you can transfer your points to a wide variety of partners, potentially unlocking even greater value for your rewards.

Keep in mind that transferring points to partners is often best when you have a specific redemption in mind, so make sure to plan your strategy accordingly.

Other Ways of Earning Chase Ultimate Rewards Points

In addition to the points earned through credit card spending, Chase offers two other ways to boost your Ultimate Rewards balance: the Shop Through Chase portal and the Refer-A-Friend program.

By utilizing these additional earning methods, you can further increase your point accumulation and make the most of your Chase Ultimate Rewards experience.

Shop Through Chase Portal

The Shop Through Chase portal is a convenient way to earn extra points while shopping online. By making purchases through the portal with any eligible Chase card, you can earn additional points on top of your base earning rate. This can help you accumulate points more quickly and effortlessly, all while shopping at your favorite online retailers.

Be sure to compare the earning rates for each of your Chase cards, as some may offer higher rates than others. Surprisingly, a no-annual fee card sometimes will earn more than a card with an annual fee!

Refer-A-Friend Program

The Chase Refer-A-Friend program is another excellent way to earn bonus points. By referring friends to open a Chase credit card using your referral link or code, you can earn extra Ultimate Rewards points as a thank you from Chase. The exact bonus amount may vary depending on the card, but it’s an easy way to boost your rewards balance by simply sharing your love for Chase credit cards with friends and family.

Maximizing Your Chase Ultimate Rewards Points

To truly make the most of your Chase Ultimate Rewards points, it’s important to have a strategy in place. By combining points across cards, engaging in strategic spending, and utilizing additional earning methods such as the Shop Through Chase portal and Refer-A-Friend program, you can maximize your rewards and unlock even greater value from your points.

Let’s explore some ways to make your points work harder for you.

Combining Points

One effective way to maximize your Chase Ultimate Rewards points is by combining them between cards. This allows you to pool your points and access redemption options that may not be available with points from no-annual fee cards.

For instance, if you hold a Sapphire Reserve card, you can transfer points from your Freedom Unlimited or Freedom Flex card and redeem them at a higher value through the Chase travel portal or to airline and hotel partners.

Strategic Spending

Another key element of maximizing your Chase Ultimate Rewards points is strategic spending. By focusing your spending on bonus categories and taking advantage of rotating offers, you can earn more points per dollar spent.

For example, if you hold the Chase Sapphire Reserve card, you could use it for travel and dining purchases to earn 3x points, while using the Freedom Unlimited card for other purchases to earn 1.5x points. This way, you can optimize your earning potential and make every dollar count.

Redeeming Chase Ultimate Rewards Points

Now that you’ve amassed a substantial balance of Chase Ultimate Rewards points, it’s time to put them to good use. Chase offers a variety of redemption options, ranging from travel and cash back to statement credits, gift cards, and shopping.

Let’s explore each of these options and discover the best ways to redeem your hard-earned points.

Travel Redemptions

One of the most popular and valuable ways to redeem your Chase Ultimate Rewards points is for travel. You can use the Chase travel portal to search for flights, hotels, cruises, vacation rentals, rental cars, and experiences, often with attractive redemption rates.

Additionally, by transferring your points to airline and hotel partners, you can potentially unlock even greater value for your rewards and enjoy a wide range of travel options.

Cash Back and Statement Credits

If you prefer a more straightforward redemption option, cash back and statement credits are an excellent choice. Chase Ultimate Rewards points can be redeemed for cash back at a rate of 1 cent per point, either as a statement credit or by depositing it into your bank account.

This simple and flexible redemption option allows you to use your points as you see fit, whether it’s to cover everyday expenses or save for a future goal.

Gift Cards and Shopping

For those who enjoy shopping and gift-giving, Chase Ultimate Rewards points can be redeemed for gift cards at a variety of popular retailers, usually at a rate of 1 cent per point. You can also use your points to shop at Amazon.com or for Apple products through the Chase Ultimate Rewards portal, although the redemption rate may be slightly lower than cash back or statement credits.

Be sure to compare the value of your points across different redemption options to ensure you’re getting the best deal possible.

Chase Ultimate Rewards Transfer Partners

One of the key advantages of Chase Ultimate Rewards is its extensive list of transfer partners, which includes several airline and hotel partners. By transferring your points to these partners, you can potentially unlock even greater value for your rewards and enjoy a wide range of travel options.

Let’s take a closer look at the airline and hotel partners available through Chase Ultimate Rewards

| Chase Ultimate Rewards Transfer Partners | Last Updated: July 2023 | |

|---|---|---|

| Transfer Ratio | Expected Transfer Time * | |

| Aer Lingus Avios | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France Flying Blue | 1:1 | Instant |

| British Airways Avios | 1:1 | Instant |

| Emirates | 1:1 | Instant |

| Iberia Avios | 1:1 | Instant |

| JetBlue | 1:1 | Instant |

| Singapore Airlines KrisFlyer | 1:1 | ~ 1 - 2 days |

| Southwest Airlines | 1:1 | Instant |

| United MileagePlus | 1:1 | Instant |

| Virgin Atlantic Flying Club | 1:1 | Instant |

| Hyatt | 1:1 | Instant |

| Marriott Bonvoy | 1:1 | ~ 1-2 days |

| IHG Rewards Club | 1:1 | ~ 24 hours |

Airline Partners

Chase has partnered with 11 airlines, including both US-based and international carriers, to offer a diverse range of options for redeeming your Ultimate Rewards points. These partners often provide some of the best value for your points, allowing you to book award flights at attractive redemption rates.

Keep in mind that each airline has its own award chart and redemption rules, so it’s essential to research and compare your options before transferring points.

Hotel Partners

In addition to airline partners, Chase Ultimate Rewards also offers three hotel partners: IHG Rewards Club, Marriott Bonvoy, and World of Hyatt. Transferring your points to these hotel partners can provide excellent value for your rewards, particularly if you’re looking to book stays at luxury properties or during peak travel periods.

As with airline partners, it’s important to compare your options and research each hotel loyalty program to ensure you’re getting the best value for your points.

For instance, and without making this guide too complex, you can see from our list of Miles and Points Valuations that World of Hyatt points are worth more than three times as much as Marriott Bonvoy r IHG points. Yet, they all transfer 1:1. Clearly, the best value here lies with World of Hyatt.

Chase Ultimate Rewards Transfer Partner Sweet Spots

To truly maximize the value of your Chase Ultimate Rewards points, it’s essential to look for sweet spots in partner programs. These sweet spots are instances where transferring points to a specific partner can yield significantly higher value than other redemption options, often allowing you to book premium flights or hotel stays at a fraction of the cost.

By being strategic and staying informed about the latest deals and promotions, you can make your points go even further.

Here’s an example using World of Hyatt points (transferred 1:1 from Chase):

This 5 star hotel on Lake Como, the Grand Hotel Victoria Concept and Spa, runs around $1,700 a night during summer. But it’s also bookable for 25,000 – 35,000 points per night. That’s close to 7 cents per point in value for your Chase points! The more effort you put in to looking for outsize value, the more you’ll get!

Grand Hotel Victoria Concept and Spa, Menaggio, Lake Como

The best redemptions using Chase Ultimate Rewards Airline and Hotel Partners

Some of the best redemptions using Chase Ultimate Rewards airline and hotel partners include booking business or first-class flights on partner airlines, securing luxurious hotel stays, and taking advantage of award availability during peak travel seasons. By transferring your points to these partners and seeking out the best deals, you can unlock incredible value and make your travel dreams a reality.

Dave flying in Singapore Suites (First Class) – using Singapore KrisFlyer miles transferred from Chase Ultimate Rewards

Managing Your Chase Ultimate Rewards Account

Effective management of your Chase Ultimate Rewards account is crucial to maximizing your rewards potential. This includes logging in and navigating the portal, combining points with family members, and staying up-to-date on the latest offers and promotions.

Let’s explore some essential tips for managing your account and making the most of your Chase Ultimate Rewards points.

Logging In and Navigating the Portal

Accessing and navigating the Chase Ultimate Rewards portal is simple and straightforward, allowing you to manage your account with ease. Log in to your Chase account, and from there, you can access the Ultimate Rewards portal to view your points balance, redeem points, transfer points to partners, and explore additional earning opportunities.

Familiarizing yourself with the portal ensures that you stay on top of your rewards and make the most of your Chase Ultimate Rewards experience.

Combining Points with Family Members

Another great way to maximize your Chase Ultimate Rewards points is by combining them with family members who also have eligible Chase credit cards. This allows you to pool your points together and access even greater redemption options.

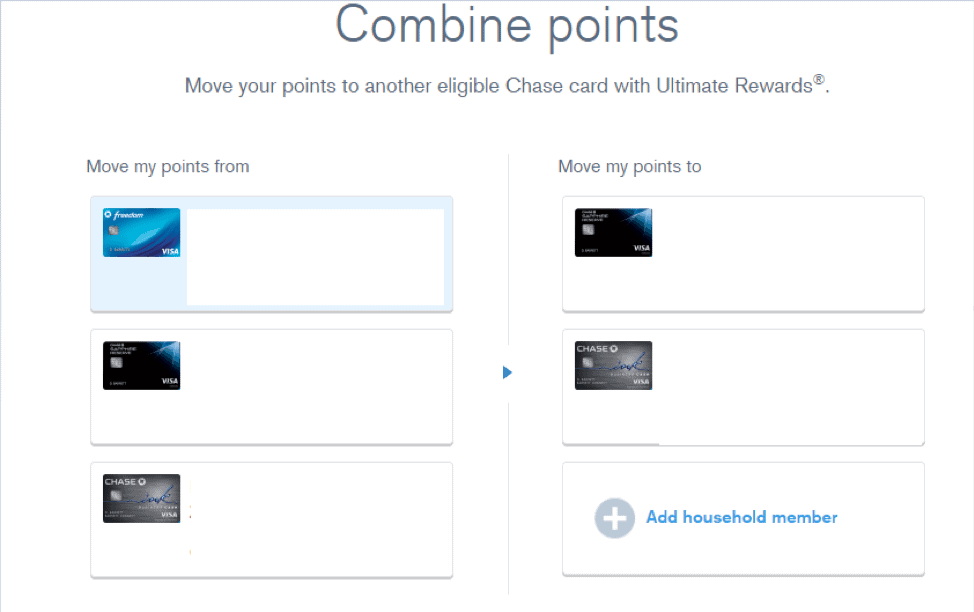

To combine points, log in to the Chase Ultimate Rewards portal, expand the “Earn/Use” tab, and click on “Combine Points.” From there, you can select the cards you want to transfer points from and to, and complete the transfer process.

Chase Ultimate Rewards – How to Combine Points

Chase Ultimate Rewards – How to Combine Points

By pooling your points with family members, you can unlock even greater value from your rewards.

You can also combine points with a household member. Both cardholders need to have the same address. For example, if another member of your household has a Sapphire Reserve and you have a Freedom Unlimited card, transfer your points to them.

Note: Do not try to “game the system” to transfer to non-family members. This can cause a shutdown of your accounts. You don’t want that!!

Summary

In conclusion, Chase Ultimate Rewards is a powerful and versatile rewards program that offers incredible earning potential and flexible redemption options. By understanding the basics of the program, strategically selecting and using Chase credit cards, and maximizing your points through various earning and redemption methods, you can unlock the full potential of your Chase Ultimate Rewards points

Questions or Comments?

The best way to ask questions about this topic is in the private MilesTalk Facebook group, where we discuss all things related to credit card rewards.

You can also follow MilesTalk / Your Best Credit Cards on Twitter, and on Instagram for anything related to miles, points, credit cards, and travel.

Frequently asked questions

What are Chase Ultimate Rewards?

Chase Ultimate Rewards is a loyalty program that allows you to earn points when you use your credit card. These points can be redeemed for cash back, gift cards, travel bookings, or transferred to partner loyalty programs.

Each point is worth one cent when used for cash back, and up to 1.5 cents each when redeemed for travel booked through Chase. They can be worth even more when strategically transferred to airline and hotel travel partners.

How much is 50,000 Chase points worth?

Chase 50,000 points offer great value – depending on which card you have, they could be worth up to $750 in travel, cash back, or gift cards!

You can get $500 with most Chase cards, or even more with select ones like the Chase Sapphire Preferred® Card or Ink Business Preferred.

How much is 100 000 Chase points worth?

100,000 Chase points are typically worth $1,000 in cash back or for travel booked through Chase Ultimate Rewards. However, the value of 100,000 dollars is not enough. Chase points can vary from as little as $750 to as much as $1,500 depending on the card you use to redeem them

How much is Chase Ultimate Rewards cash back worth?

Chase Ultimate Rewards cash back is worth 1 cent per point, which can be increased up to 1.5 cents per point when redeeming for travel booked through Chase.

Additionally, annual fee cards can offer points worth 25-50% more than 1 cent per point.

What is Chase Ultimate Rewards?

Chase Ultimate Rewards is a great way to save money and redeem rewards for everything from flights to gift cards. With a variety of cards offering different bonus points, and with multiple partners to transfer points to, you can get maximum value from your points.

Plus, it’s easy to redeem them, making your money go further