Key facts

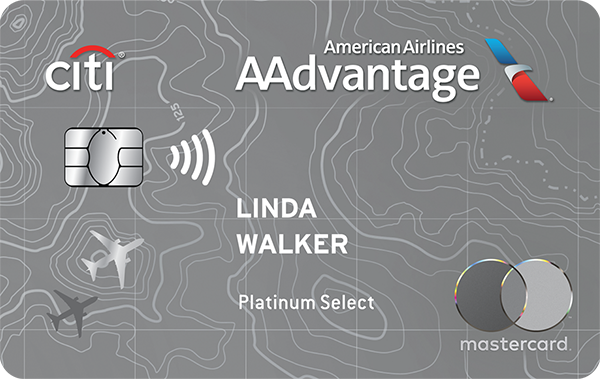

The Citi® / AAdvantage® Platinum Select® World Elite MasterCard justifies its annual fee even if you only occasionally fly American Airlines.

Annual Fee:

$99 $0 Introductory Annual Fee for the first year, then $99Min. Credit Score for Approval:

670-739 * GoodOngoing APR:

20.99%-29.99% VariableForeign Transaction Fee:

0%The Citi® / AAdvantage® Platinum Select® World Elite MasterCard offers travelers elite-like perks like a free checked bag, preferred boarding, and a discount on in-flight food and beverage purchases. Add in no foreign transaction fees and this card offers well-rounded perks for just a $99 annual fee.

Reward multipliers

Citi AAdvantage Platinum Select World Elite Mastercard cardholders earn 2 AAdvantage miles per dollar spent at gas stations, restaurants, and on eligible American Airlines purchases. All other eligible purchases earn 1 mile per dollar spent. All eligible purchases earn 1 Loyalty Point per dollar spent.

Earns bonus points for spend in the following bonus categories:

Key features

Unique Card Benefits

$125 American Airlines Flight Discount

Earn a $125 American Airlines flight discount after spending $20,000 or more in purchases during your card year and paying the annual fee to renew your card.

As described in the features below, you’ll also get a free checked bag domestically for you and up to four companions on the same reservation as well as priority boarding.

Free Checked Bags

Primary cardholders can check a bag for free anytime they fly on domestic American Airlines itineraries. Even better, up to four companions can also get a free checked bag when traveling with the primary cardholder. However, companions need to be booked on your reservation to get a checked bag free.

Priority Boarding

The AAdvantage® Platinum Select credit card provides cardholders with Group 5 preferred boarding. While it’s not technically priority boarding, Group 5 still means you’ll be able to board early in the boarding process, before any non-elite economy American Airlines passengers.

Extended Warranty

The Citi AAdvantage® Platinum Select credit card offers an extended warranty on eligible purchases made with the card. This protection extends the manufacturer’s warranty by up to 24 months.

Purchase Protection

Cardholders get complimentary Damage & Theft Purchase Protection on purchases made with the Citi AAdvantage® Platinum Select World Elite Mastercard. This protects against theft or damage of eligible purchases within 90 days of purchase.

No Foreign Transaction Fees

The Citi AAdvantage® Platinum Select World Elite Mastercard doesn’t charge foreign transaction fees.

Free Access to Credit Score

Cardholders of the Citi AAdvantage® Platinum Select can check their FICO® credit score each month for free.

No Fees for Authorized Users

Citi AAdvantage® Platinum Select cardholders can add authorized users at no additional charge. Authorized users can help you earn American Airlines AAdvantage® miles and spend toward the bonus miles earned after account opening.

However, authorized users don’t get perks like the free checked bag benefit or preferred boarding.

Earn more rewards by combining credit cards

Pros & cons

- Get a free checked bag on domestic American Airlines itineraries (for the primary cardholder and up to four companions)

- Avoid having to gate-check your carry-on bag thanks to Group 5 preferred boarding

- Earn Loyalty Points toward AAdvantage® elite status through credit card spending

- Limited bonus miles categories

- Card perks are limited to travel on American Airlines flights

- Miles earned can only be used inside of the AAdvantage® program

Our review

Citi® / AAdvantage® Platinum Select® World Elite MasterCard is the perfect card for travelers that even periodically fly American. For a $99 annual fee (waived the first year), cardholders and travelers on the same reservation enjoy preferred boarding, a free checked bag on American Airlines flights, and 25% savings on inflight food and beverage purchases.

Cardholders earn 2x American Airlines AAdvantage® bonus miles at restaurants and gas stations and on eligible American Airlines purchases. All other eligible purchases earn 1x AAdvantage® miles per eligible dollar spent.

Each dollar spent on an American Airlines credit card earns 1 Loyalty Point. That means cardholders can earn elite status in the AAdvantage program just by spending on the AAdvantage® Platinum Select card. For example, you can earn AAdvantage® Gold elite status with just $40,000 in purchases on the card in a year.

Note that the sign up bonus and spending category bonuses count as American Airlines AAdvantage® bonus miles. That means you won’t earn Loyalty Points on these AAdvantage® bonus miles. As an example, if you spend $5,000 at gas stations in a year, although you’ll earn 10,000 AAdvantage® miles on these purchases, it will only count as 5,000 Loyalty Points.

American Airlines currently charges $40 for a first checked bag on domestic itineraries. Considering you and up to four travel companions can check a bag for free, this one credit card perk can save you up to $400 per round-trip flight. The catch is that this perk only is offered on domestic flights. Unfortunately, cardholders can’t check a bag for free on American Airlines international flights.

Frequently asked questions

Does the Citi AAdvantage Platinum Select credit card charge foreign transaction fees?

No, the Citi AAdvantage Platinum Select credit card doesn’t charge foreign transaction fees.

How many miles does the Citi American Airlines AAdvantage credit card earn on eligible American Airlines purchases?

You’ll earn 2 American Airlines AAdvantage® bonus miles per dollar spent on eligible American Airlines purchases using the AAdvantage Platinum Select World Elite Mastercard. You’ll also earn bonus miles at restaurants and gas stations and 1 AAdvantage® mile on all other purchases.

Does the Citi AAdvantage Platinum Select come with an Admirals Club membership?

The Citi AAdvantage Platinum Select doesn’t offer an Admirals Club® membership or any form of airport lounge access. To get access to the Admirals Club® via an American Airlines credit card, you’ll need to sign up for the Citi® / AAdvantage® Executive World Elite MasterCard®.

Cardholders of the AAdvantage Executive Card can access the Admirals Club each time they fly along with up to two guests. Plus, the Executive World Elite Mastercard offers perks like a Global Entry application fee statement credit.

How does the free checked bag benefit work on the AAdvantage Platinum Select World Elite Mastercard?

AAdvantage Platinum Select cardholders and up to four companions get free checked bags on domestic itineraries on American Airlines. To be eligible to get their first checked bag free, all travelers must be booked on the same reservation and be booked exclusively on domestic flights.

Do AAdvantage Platinum Select cardholders get priority boarding?

Citi AAdvantage Platinum Select World Elite Mastercard cardholders and up to four companions on the same reservation enjoy Group 5 boarding on American Airlines flights.

What are some of the ways of redeeming AAdvantage miles?

You can redeem AAdvantage® miles for nearly free flights on American Airlines or more than a dozen partner airlines – including Alaska Airlines, Japan Airlines, Cathay Pacific, and British Airlines. American Airlines is part of the Oneworld alliance meaning that you can redeem AAdvantage miles on Oneworld partner airlines.

Does the AAdvantage Platinum Select card offer lost luggage insurance?

Unfortunately, the AAdvantage Platinum Select World Elite Mastercard doesn’t offer travel protections like lost luggage insurance, trip delay protection, or trip cancellation insurance as part of the card’s benefits.

Is the AAdvantage Platinum Select worth the annual fee?

Thanks to valuable perks like free checked bags, preferred boarding, and bonus AAdvantage® miles on eligible American Airlines purchases, the AAdvantage Platinum Select can be worth it for even occasional American Airlines flyers. It’s even more valuable if you’re a frequent American Airlines flyer.

Should I get the AAdvantage Platinum Select or CitiBusiness AAdvantage Platinum Select?

If you’re a small business owner, consider signing up for the CitiBusiness AAdvantage Platinum Select World Elite Mastercard to earn AAdvantage miles on cable and satellite providers, gas stations, telecommunications merchants, car rental merchants, and eligible American Airlines purchases. Cardholders of the CitiBusiness Card enjoy preferred boarding, save 25% on in flight purchases, and get the first checked bag free.

Should I get the AAdvantage Platinum Select or MileUp Card?

If you’re looking for a no annual fee American Airlines credit card, Citi also offers the American Airlines AAdvantage® MileUp®. Despite no annual fee, the MileUp Card offers American Airlines AAdvantage bonus miles on American Airlines purchases and at grocery stores – including online grocery purchases.