Key facts

No annual fee, but still packed with perks.

Annual Fee:

$0Min. Credit Score for Approval:

670-739 * GoodOngoing APR:

21.49%-28.49% VariableBalance transfer fees

Either $5 or 5% of the amount of each transfer, whichever is greater.Foreign Transaction Fee:

0%Despite charging no annual fee, the IHG® Rewards Traveler Credit Card still offers an impressive set of benefits. Just by holding the IHG Traveler Card, travelers get their fourth night free on reward stays, automatic Silver Elite status in IHG Rewards, and a 20% discount on points purchases. Plus, cardholders can rack up IHG points through the generous sign-up bonus and earn bonus points in several bonus categories.

Reward multipliers

In addition to the sign-up bonus, the IHG Rewards Traveler Credit Card earns bonus points in several categories:

- 5 points per dollar spent at eligible IHG hotels and resorts.

- 3 points per dollar spent on monthly bills, including utilities, internet, cable, and phone services, and select streaming services

- 3 points per dollar spent at gas stations.

- 3 points per dollar spent at restaurants, including takeout and eligible delivery.

- 2 points per dollar spent on all other purchases.

On top of these points earned from spending, the Traveler Credit Card also offers two spending threshold bonuses. Cardholders will earn 10,000 bonus points after spending $10,000 in a calendar year. Then, after spending $20,000 in a calendar year, cardholders will get IHG Gold Elite status.

Earns bonus points for spend in the following bonus categories:

At IHG brand hotels and resorts booked directly; otherwise earn 2X.

Estimated Rewards Value: 2%

Estimated Rewards Value: 1.2%

Estimated Rewards Value: 1.2%

Estimated Rewards Value: 1.2%

Estimated Rewards Value: 1.2%

Estimated Rewards Value: 1.2%

Estimated Rewards Value: 0.8%

Key features

Unique Card Benefits

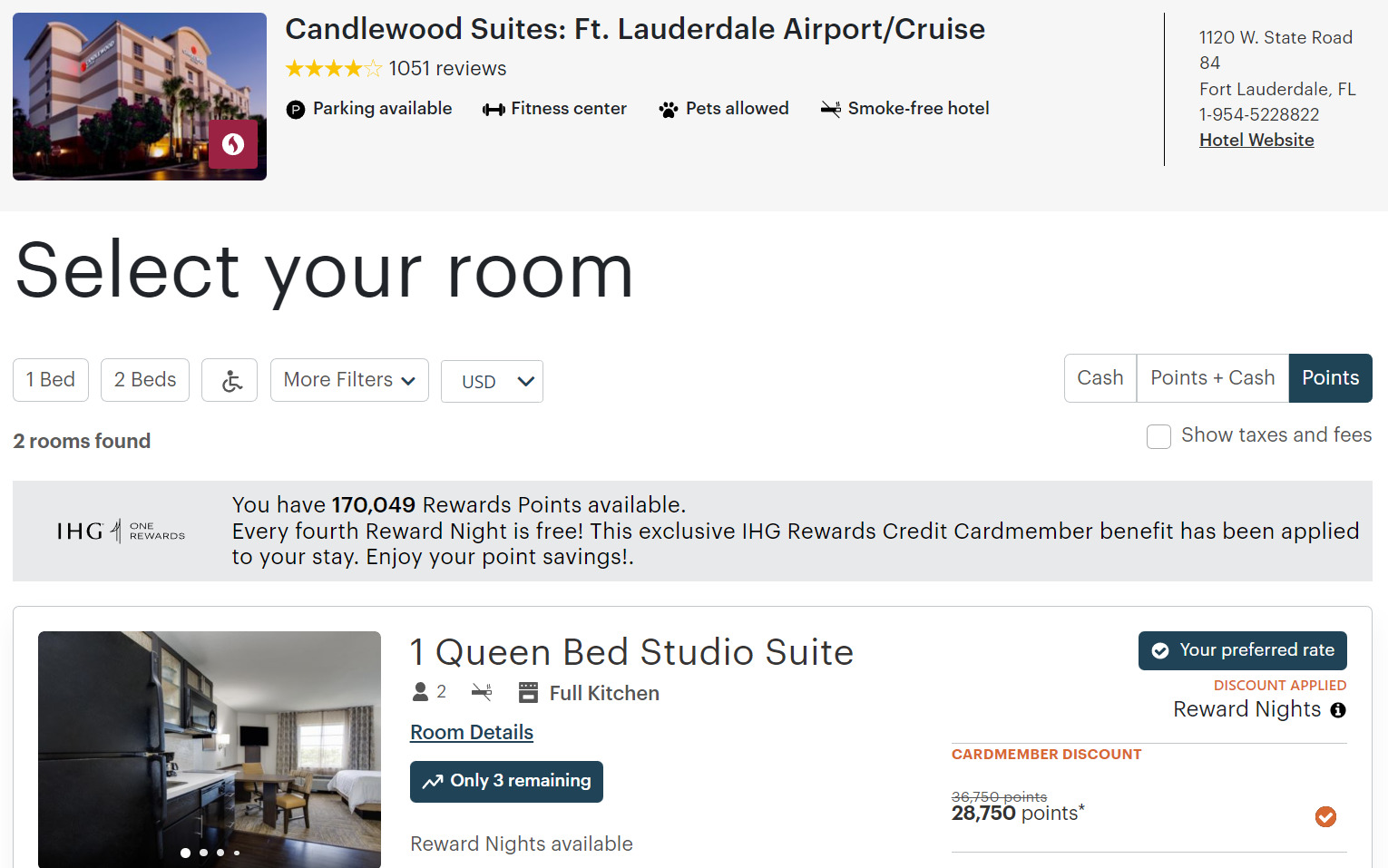

Fourth Reward Night Free

Get a fourth reward night free when you redeem points for four (or more) consecutive rewards nights. Although this benefit is called the fourth night free, the free night will actually be the least expensive night.

20% Off IHG Points Purchases

Use your IHG Traveler Card to purchase points and get a 20% discount off the standard price.

Secondary Car Rental CDW Waiver

Use your IHG Traveler Card to pay in full for your rental and decline the rental company’s insurance to get theft and collision damage on rental cars, both in the U.S. and overseas. For rentals within the U.S., coverage is secondary to your personal insurance. Terms and conditions apply.

Grants Hotel Status

Primary cardholders of the IHG Traveler Credit Card automatically get IHG Rewards Silver Elite status. Upgrade to Gold Elite status by spending $20,000 on purchases in a calendar year.

Extended Warranty

Get an extra year of protection on eligible U.S. manufacturer warranties of three years or less on purchases made using your IHG Rewards Traveler Credit Card.

Purchase Protection

Covers against damage or theft for new purchases made using your IHG Rewards Travel Credit Card for the first 120 days, up to $500 per claim.

Trip Protections

When you purchase travel using your IHG Rewards Traveler Credit Card, you’ll get trip cancellation/interruption insurance (up to $5,000 per person), lost luggage reimbursement (up to $3,000 per passenger), baggage delay insurance (up to $100 a day for three days), and travel accident insurance (up to $500,000).

No Foreign Transaction Fees

In a rarity for a no-annual-fee card, the IHG One Rewards Traveler Credit Card doesn’t charge foreign transaction fees on overseas purchases.

Free Access to Credit Score

Chase offers free credit score access through Chase Credit Journey.

Travel and Emergency Assistance Services

The Chase Benefits Administrator can help refer you to legal or medical services or provide other travel and emergency assistance. It does not cover any fees incurred for the services provided.

No Fees for Authorized Users

Add authorized users to your IHG Rewards Traveler Credit Card for no annual fee and earn points on purchases made at IHG hotels, gas stations, and all other purchases.

Earn more rewards by combining credit cards

Pros & cons

- Get a fourth night free on all reward night stays of 4+ nights.

- No annual fee.

- Solid sign up bonus points, especially for a no annual fee card.

- Doesn't come with a free night award, like the IHG Premier Card

- Complimentary Silver Elite status doesn't offer many perks

Our review

The IHG Rewards Traveler Credit Card is IHG’s no-annual-fee credit card. As such, it doesn’t offer the excellent perks that come with the IHG Premier Credit Card — like a free night each account anniversary, automatic Platinum Elite status, and other travel perks.

However, the IHG Traveler Card still offers surprisingly good benefits for a no-annual-fee card. You’ll get IHG Rewards’ intro level Silver Elite status, fourth night free on rewards stays, and a 20% discount on purchases of IHG Rewards points.

Silver Elite status doesn’t offer too many perks — 20% bonus points at IHG hotels and resorts, a shot at late checkout, and not having to worry about point expiration. Cardholders can spend $20,000 in a calendar year to upgrade to Gold Elite status. Gold Elite status includes 40% bonus points at IHG hotels and resorts.

In addition to the sign-up bonus, IHG Rewards Traveler Credit Card cardholders will earn bonus points on IHG hotel stays, dining, gas stations, select streaming services, and utility monthly bills. Cardholders earn 2 points per dollar spent on all other eligible purchases. Considering the IHG Rewards point value is only around 0.4 cents per point, that’s not the best possible return on your other purchases.

So, you might just want to limit using your IHG Traveler Card to IHG hotels and resorts. By charging IHG hotel stays to their IHG Traveler Card, cardholders will earn a total of at least 17 points per dollar spent:

- 5 points per dollar spent by charging the IHG hotel stay to their IHG Traveler Card

- 10 points per dollar spent as an IHG Rewards member.

- 2 bonus points per dollar spent at as Silver Elite (or more if you have a higher tier of IHG Rewards elite status)

For those unfamiliar, the IHG Rewards loyalty program includes a wide range of hotel brands. On the luxury side, you can earn and redeem IHG points at InterContinental Hotels, Kimpton, Hotel Indigo, Six Senses, and Regent Hotels. On the flip side, you can earn and redeem IHG points for stays at Holiday Inn Express, Holiday Inn, Holiday Inn Club Vacations, Candlewood Suites, and Staybridge Suites. That range of earning and redemption options is truly impressive.

Frequently asked questions

Should you get the IHG Rewards Traveler Card or IHG Premier Credit Card?

Unless you’re strictly adverse to paying an annual fee, we recommend that even infrequent travelers should get the IHG Rewards Premier Credit Card instead of the IHG Traveler Credit Card. For a $99 annual fee, IHG Rewards Premier Card cardholders get a free reward night each cardholder anniversary, Platinum Elite status, and $50 in United TravelBank Cash each calendar year. Those perks are going to be well worth the annual fee.

Is it better to earn Chase Ultimate Rewards points or IHG points?

Chase Ultimate Rewards points transfer to IHG Rewards. That means points earned through cards like the Chase Sapphire Preferred can be transferred to IHG Rewards. However, IHG is one of the least-valuable Chase Ultimate Rewards transfer partners. So, you’re generally better off redeeming points through the Chase Travel Portal than transferring to IHG Rewards.

Is the IHG Traveler Card a good rewards card?

Despite having the lowest annual fee of any IHG card, the IHG Rewards Traveler Credit Card is a still solid hotel credit card. Despite no annual fee, earn bonus points per dollar spent at IHG properties, gas stations, and more. Plus, get IHG Rewards elite status and a fourth night free on rewards stays. And the Traveler Credit Card is one of few no-annual-fee cards with no foreign transaction fees.

Does IHG have a credit card with no annual fee?

The IHG Rewards Traveler Credit Card is IHG’s no-annual-fee hotel rewards credit card. Despite no annual fee, cardholders get IHG Rewards elite status and bonus points when staying at IHG hotels. Plus, get a fourth reward night free when you redeem points for at least four reward nights.

Which credit card issuer offers the IHG Traveler Card?

Chase issues the IHG Rewards Traveler Credit Card, the IHG Rewards Premier Card, and the business IHG credit card.

How do you earn bonus points on the IHG Traveler Card?

In addition to the sign-up bonus earned after account opening, the IHG Rewards Traveler Credit Card earns 5 points per dollar at IHG hotels; 3 points per dollar on dining, gas stations, and monthly bills like utilities and select streaming services; and 2 points per dollar on all other purchases.

Do IHG Rewards points expire?

Generally, IHG points expire if you don’t have activity in your IHG Rewards account for 12 months. An IHG Rewards member can generate activity earning or redeeming rewards points. However, the IHG Rewards membership terms and conditions state that points don’t expire for IHG Rewards elite members. That means IHG credit card cardholders won’t have to worry about points expiring.

Can you upgrade from the IHG Rewards Traveler Card to the Premier Credit Card?

Chase may let you upgrade your IHG Rewards Traveler Card to the IHG Rewards Premier Credit Card. Doing so will boost your IHG Rewards elite status to Platinum Elite status and boost your rewards rate on IHG hotel stays. However, you generally won’t earn a welcome bonus when upgrading your hotel credit card.

How does the IHG One Traveler Card compare to the IHG One Premier Card

You can compare the IHG One Traveler Card and the IHG One Premier Card here.